- info@fornav.com

- +45 7199 1915

E-invoicing

Support for e-invoicing in Microsoft Dynamics 365 Business Central (XRechnung & ZUGFeRD)

German version

E-invoicing standards

E-invoicing is the electronic exchange of invoices between businesses and their clients or trading partners. It eliminates the need for traditional paper-based invoices, reducing manual effort, minimizing errors, and accelerating payment processing. Electronic invoicing uses digital technologies to create, send, receive, and archive invoices in a structured electronic format. This digital format makes it easier for businesses to automate invoice processing, track payments, and maintain compliance with tax regulations.

Governments across Europe, including France and Germany, are implementing mandatory electronic invoicing rules aimed at enhancing tax transparency and operational efficiency. While specifics vary by country, the overarching objective is to combat fraud and to foster transparency, efficiency, and tax adherence in financial transactions and e-invoicing practices. For businesses, compliance with these regulations is essential to sidestep penalties, streamline financial workflows, and sustain competitiveness in global markets.

In Germany, XRechnung and ZUGFeRD are commonly used standards to meet these regulations. Whether you are using XRechnung or ZUGFeRD, ForNAV has the solution to cover your needs.

You can read more about the e-invoicing standards in Germany on the Federal Government’s website.

XRechnung

XRechnung is an XML-based invoice format that has been chosen as the standard for electronic invoicing for public sector clients in Germany, to comply with EU directive 2014/55/EU. EU directive 2014/55/EU requires the use of electronic invoicing in public procurement across the EU to improve efficiency and reduce costs.

The XRechnung standard defines how invoice information should be formatted and transmitted using XML. It ensures that various software systems can receive and process electronic invoices seamlessly.

ZUGFeRD

ZUGFeRD, short for “Zentraler User Guide des Forums elektronische Rechnung Deutschland” (Central User Guide of the Forum for Electronic Invoices Germany), is an open standard for electronic invoices. Developed in Germany, ZUGFeRD is designed to facilitate the exchange of structured electronic invoices in a format that combines both human-readable and machine-readable data.

The core idea behind ZUGFeRD invoices is to create universally compatible invoices that can be read and understood by humans while also being processed efficiently by computer systems. It achieves this through the use of PDF/A-3, a standard PDF format, combined with an embedded XML file. This unique combination ensures that the invoice is accessible to all, regardless of the recipient’s technological capabilities, while also enabling automated data extraction and processing.

While XRechnung is compulsory for public procurement, ZUGFeRD is an alternative option for broader invoicing needs. It is widely used in both the public and private sectors due to its flexibility.

The current XRechnung and ZUGFeRD standards only allow two XML formats for the transmission of electronic invoices: either UBL or UNCEFACT/CII. The ForNAV e-invoicing solution supports the UNCEFACT/CII standard.

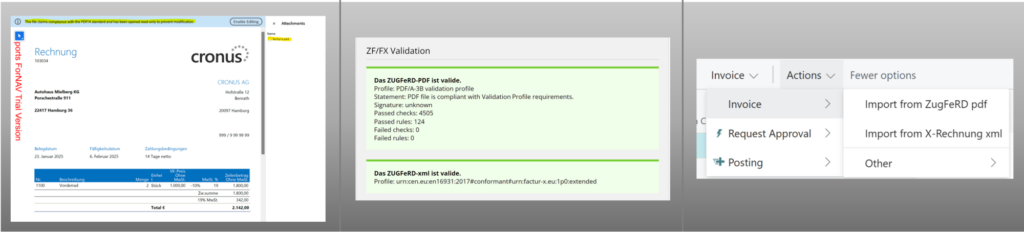

ForNAV electronic invoice support for e-invoicing (XRechnung & ZUGFeRD)

For Microsoft Dynamics 365 Business Central users that must meet e-invoicing standards (for example, companies in Germany), Microsoft recommends turning to partner-developed apps such as ForNAV electronic invoice support for XRechnung and ZUGFeRD.

The ForNAV solution is easy to implement and simple to use and allows Microsoft Dynamics 365 Business Central clients to comply with existing and upcoming mandatory regulations. The ForNAV solution supports your e-invoicing needs – it allows you to:

- Create XRechnung- and ZUGFeRD-compliant e-invoices in Business Central

- Send these invoices to relevant public authorities or business partners via email

- Import XRechnung- and ZUGFeRD-compliant e-invoices in Business Central

The simplest and fastest way to become ZUGFeRD or XRechnung compliant

To make your Business Central Word and ForNAV documents (for example, invoices and credit memo reports) ZUGFeRD or XRechnung compliant, all you have to do is install the ForNAV extension. It is that simple and you are ready to go:

- No additional setup is needed to support the standard Business Central application functionality

- Installing the ForNAV extension is simple and fast

- It works out of the box, covering standard needs without any extra cost for consultancy or extra coding

- If you need to, you can easily modify it to support any customizations of Business Central document tables or to support other ZUGFeRD or XRechnung document types

Access to the ForNAV extension is included in your standard ForNAV license from version 7.2. Download ForNAV today and you will get access to it. This also means that all existing ForNAV customers automatically get access to it as part of the 7.2 update – at no cost.

How does the ForNAV solution work?

The solution developed by ForNAV allows you to create, import and send ZUGFeRD and XRechnung compliant invoicing. The ForNAV e-invoicing solution:

- Supports all ZUGFeRD and XRechnung invoices as well as Factur-X (XML embedded in PDF) profiles

- Works for invoices & credit notes – other document types can easily be added if there is a need

- Supports ForNAV reports and documents as well as standard Microsoft RDLC and Word documents

- Comes with a set of Business Central Tables representing a superset of profiles

- Provides a default mapping to Business Central Sales Invoice, Sales Credit Memo, Purchase Invoice and Purchase Credit Memo documents. The mapping is performed in events that can be overridden/modified in AL-code

- Supports the XRechnung and ZUGFeRD UNCEFACT/CII standard

Get the ForNAV solution for e-invoicing (XRechnung, ZUGFeRD) now

Get the ForNAV solution to stay compliant and remain competitive in the evolving landscape of e-invoicing practices. Download via Microsoft AppSource (for Cloud) or from our website (for OnPrem/Universal Code).

The ForNAV solution for electronic invoicing also supports Factur-X. Note that ZUGFeRD/XRechnung are only supported on Microsoft Dynamics Business Central version 20.3 and up, using Universal Code and Cloud.

E-invoices distribution

Once you have created XRechnung or ZUGFeRD compliant e-invoices in your Business Central, your next challenge is to transfer them to your relevant business partners or authorities.

Distributing e-invoices can be done using different distribution channels. In Germany, you can use the official ZRE and OZG-RE submission portals.

Using e-mails as e-invoice distribution method

It is also possible to use e-mails as a distribution method for your e-invoices. With the ForNAV solution, you can produce an XRechnung or ZUGFeRD-compliant document in Business Central and simply send it by e-mail.

Peppol – an easy path to XRechnung and ZUGFeRD e-invoices distribution

Finally, one of the easiest and most secure ways of distributing e-invoices while meeting regulatory requirements is the fully automated transmission via the Peppol network (Pan-European Public Procurement OnLine).

Peppol is a compilation of components and specifications enabling the standardised exchange of documents between different business partners, using the infrastructure of the Peppol network.

Sending e-invoices using the Peppol network is one of the transmission methods accepted by all German authorities, but the only one supporting machine-to-machine communication and the mass sending of e-invoices.

The upcoming release of ForNAV (7.4) expected in the fall 2024 will make it possible to send and receive e-invoices from Business Central using the Peppol network.

Factur-X: An alternative to XRechnung and ZUGFeRD

In addition to ZUGFeRD and XRechnung, another notable electronic invoices standard has gained prominence: Factur-X.

Factur-X (FacturX) is a format used primarily in France and that is designed to be compatible with both French and German invoicing requirements. While it originated in France, it has gained recognition in other European countries as well, making it suitable for international invoicing. It combines the advantages of both PDF and XML formats, making invoices human-readable while maintaining machine-readability.

Additional resources

- Fact sheet: Download the ForNAV e-invoicing (ZUGFeRD/XRechnung) solution fact sheet in PDF format

- Get started guide: Read the short ForNAV ZUGFeRD solution guide to learn more about how to install, set up and customize it

- You can download the ForNAV solution for e-invoicing (ZUGFeRD/XRechnung) here (for OnPrem) or from Microsoft AppSource (for Cloud)

- General information: Read more about ZUGFeRD 2.2

Keywords: ZUGFeRD; XRechnung; E-Invoicing; XRechnung invoices; ZUGFeRD Invoices; XRechnung standard; Electronic Invoices; Microsoft Dynamics 365 Business Central; ZUGFeRD Standards; ZUGFeRD Compliant Invoicing; E-invoicing regulations; Digital Invoicing; Compliance with ZUGFeRD; Compliance with XRechnung; Factur-X; FacturX